Market Jitters: How Shifting Interest Rate Expectations Impact Your Investments in 2025 (USA, UK, Canada)

Introduction: The financial markets in the USA, UK, and Canada are currently experiencing a significant period of “jitters.” This heightened uncertainty is largely driven by daily shifts in expectations regarding future interest rate decisions from central banks. Following mixed economic data and cautious statements from policymakers, investors are grappling with how these evolving outlooks will impact everything from stocks and bonds to real estate in 2025. Understanding these market dynamics is crucial for protecting your portfolio and making informed investment decisions amidst the ongoing volatility.

The Shifting Sands: What’s Driving Interest Rate Expectations?

This section will explain why interest rate expectations are so volatile right now.

Central Bank’s Tightrope Walk

- Inflation vs. Growth: Explain how central banks are trying to balance controlling inflation (by potentially raising rates) with avoiding a recession (by potentially lowering or holding rates).

- Data Dependency: How every new piece of economic data (inflation reports, jobs numbers, consumer spending) can sway market predictions on future rate moves.

Policymaker Commentary

- Speeches & Statements: How public comments from central bank governors (e.g., Fed Chair, BoE Governor, BoC Governor) are closely watched and can cause immediate market reactions.

- Market’s Interpretation: Sometimes, the market reacts more to perceived signals than direct announcements.

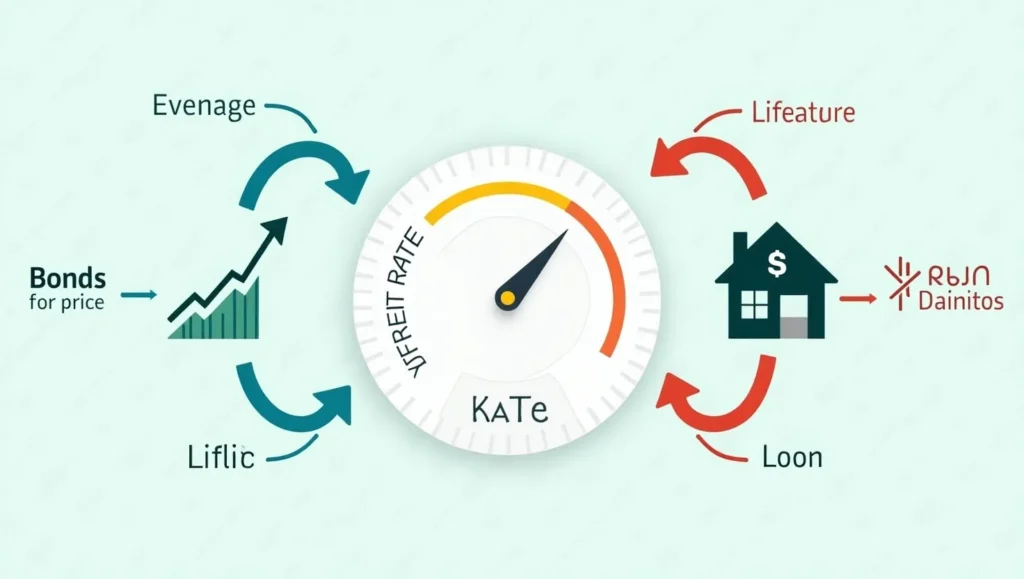

Direct Impact: How Your Investments React to Rate Shifts

Interest rate expectations cast a wide net, affecting various asset classes differently.

1. Bond Markets: Immediate Reactions

- Inverse Relationship: Explain that bond prices generally fall when interest rates (or expected rates) rise, and vice versa.

- Yields: How bond yields move in the opposite direction of prices, reflecting new interest rate expectations.

- Portfolio Impact: How this affects existing bond holdings and new bond purchases.

2. Stock Markets: Volatility Ahead

- Borrowing Costs: Higher expected rates mean higher borrowing costs for companies, which can impact profits and stock valuations.

- Discounted Future Earnings: Explain that higher interest rates reduce the present value of a company’s future earnings, making growth stocks less attractive.

- Sectoral Impact: How different sectors react (e.g., tech growth stocks often hit harder than value stocks).

3. Real Estate: Affordability and Demand

- Mortgage Rates: How shifting interest rate expectations directly influence fixed and variable mortgage rates, impacting affordability for buyers.

- Property Values: Higher rates can cool down the housing market by reducing demand, potentially affecting property appreciation.

- Rental Market: Indirect effects as homeownership becomes less accessible, increasing rental demand.

Strategies to Navigate Market Jitters in 2025

Understanding the impact is key, but proactive strategies are crucial for investors.

1. Diversify Your Portfolio

- Action: Don’t put all your eggs in one basket. Spread investments across different asset classes (stocks, bonds, cash, real estate) and sectors.

- Benefit: Reduces overall risk during volatility.

2. Focus on Quality & Value

- Action: During uncertain times, prioritize companies with strong balance sheets, consistent earnings, and clear competitive advantages.

- Benefit: These tend to be more resilient.

3. Stay Invested (Long-Term Perspective)

- Action: Avoid panic selling based on short-term market fluctuations. Time in the market often beats timing the market.

- Benefit: Ride out the volatility for long-term growth.

4. Rebalance Your Portfolio Strategically

- Action: Periodically review your asset allocation to ensure it aligns with your risk tolerance and goals, adjusting as needed.

- Benefit: Helps you stay on track and potentially buy assets “on sale” during downturns.

5. Consider Cash as an Opportunity

- Action: High-yield savings accounts and short-term Treasuries offer decent returns in a high-rate environment, providing liquidity for future opportunities.

- Benefit: A safe haven and a ready fund for strategic investments.

The Role of Informed Decision-Making

Staying updated is your best defense against market jitters.

- Follow Central Bank News: Keep an eye on announcements and speeches from the Fed, BoE, and BoC.

- Economic Data: Understand key economic indicators (inflation, employment, GDP).

- Professional Advice: Consult a qualified financial advisor for personalized guidance, especially during volatile periods.

Conclusion: In 2025, the shifting landscape of interest rate expectations is undoubtedly creating market jitters for investors across the USA, UK, and Canada. From bonds and stocks to real estate, every asset class feels the ripple effect of central bank decisions. However, by understanding these dynamics and proactively implementing smart strategies like diversification, focusing on quality, and maintaining a long-term perspective, you can confidently navigate the volatility. Stay informed, stay disciplined, and turn market uncertainty into potential opportunity for your financial portfolio.