Demystifying NFTs: A Beginner’s Guide to Non-Fungible Tokens in 2025 (USA, UK, Canada)

Introduction: In the ever-evolving digital landscape of 2025, you’ve likely heard the buzz around NFTs (Non-Fungible Tokens). Once a niche topic, NFTs have exploded into mainstream consciousness in the USA, UK, and Canada, transforming industries from art and gaming to music and real estate. But what exactly are these unique digital assets, and why are they so significant? This beginner’s guide will demystify NFTs, explain how they work, and help you understand their potential in the digital economy.

What Exactly is an NFT? The Basics of Non-Fungible Tokens

This section will clearly define NFTs and differentiate them from cryptocurrencies.

Fungible vs. Non-Fungible: A Simple Analogy

- Fungible: Explain like a dollar bill or a Bitcoin – interchangeable, each unit is identical and has the same value.

- Non-Fungible: Explain like a unique piece of art or a specific real estate property – one-of-a-kind, cannot be replaced by another identical item.

NFTs and Blockchain Technology

- Blockchain as the Backbone: Explain that NFTs exist on a blockchain (like Ethereum), which acts as a secure, decentralized digital ledger.

- Proof of Ownership: How the blockchain records and verifies unique ownership of a digital item, making it verifiable and transparent.

- Scarcity and Uniqueness: The blockchain ensures each NFT is unique and provably scarce, even if the underlying digital file can be copied.

How Do NFTs Work? A Step-by-Step Breakdown

This section will explain the technical process in an easy-to-understand manner.

1. Creation (Minting an NFT)

- Process: Briefly describe how a digital file (art, music, GIF) is “minted” on a blockchain, creating a unique token.

- Cost: Mention gas fees (transaction costs) involved in minting.

2. Ownership and Metadata

- Digital Certificate: Explain that the NFT itself is a unique digital certificate of ownership, pointing to the underlying digital asset.

- Metadata: How the NFT stores information like creator, date, and a link to the digital file.

3. Buying and Selling NFTs

- Marketplaces: Discuss platforms where NFTs are traded (e.g., OpenSea, Rarible – use generic terms for platforms, not specific names in the article).

- Cryptocurrency: How NFTs are typically bought and sold using cryptocurrencies (like Ethereum’s Ether – ETH).

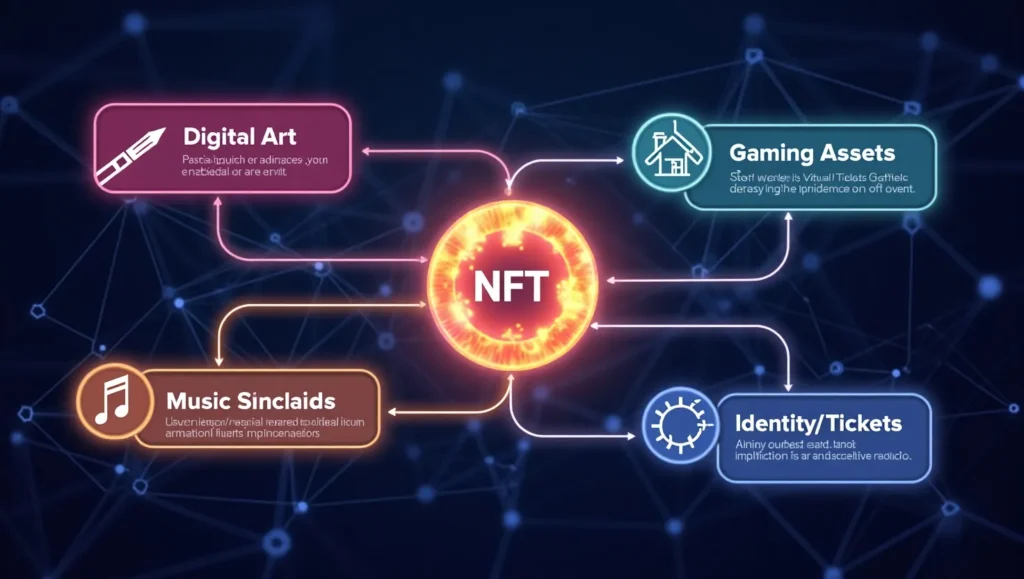

The Diverse World of NFTs: More Than Just Digital Art

NFTs have applications far beyond what many initially perceived.

Digital Art and Collectibles

- Evolution of Art Ownership: How NFTs provide verifiable ownership for digital artists.

- Examples: Famous digital artworks, unique profile pictures (PFPs).

Gaming and Metaverse Assets

- In-Game Items: Ownership of virtual land, characters, weapons, or skins within blockchain games.

- Metaverse Property: Buying virtual real estate in digital worlds.

Music and Entertainment

- Royalties & Fan Engagement: Artists selling unique tracks or experiences as NFTs, potentially giving fans a stake.

Ticketing, Identity, and Beyond

- Event Tickets: Unique, verifiable digital tickets.

- Digital Identity: Potential for NFTs to represent digital passports or credentials.

- Real-World Assets: Tokenizing ownership of physical items (e.g., real estate deeds).

Risks and Considerations for NFT Enthusiasts in 2025

While exciting, the NFT market comes with its own set of risks.

- Volatility: NFT values can be highly speculative and fluctuate wildly.

- Liquidity: Finding buyers for less popular NFTs can be challenging.

- Scams and Fraud: The nascent market is susceptible to scams, phishing, and fake projects.

- Environmental Concerns: The energy consumption of some blockchains (though improving) is a point of debate.

- Regulatory Uncertainty: The legal and tax landscape for NFTs is still evolving in the USA, UK, and Canada.

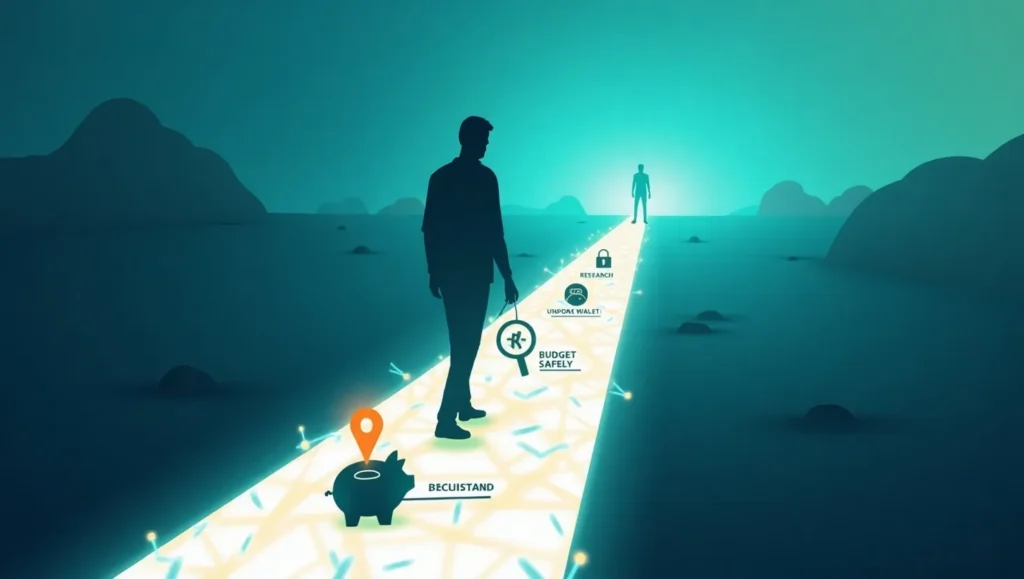

Getting Started with NFTs (Safely) in 2025

If you’re intrigued, here’s how to dip your toes into the NFT world responsibly.

1. Do Your Research (DYOR)

- Action: Never invest in something you don’t understand. Research the project, the creator, and the community behind an NFT.

2. Set a Budget (Only Invest What You Can Afford to Lose)

- Action: NFTs are high-risk. Treat any investment as entertainment money, not core savings.

3. Choose a Reputable Wallet and Marketplace

- Action: Use secure cryptocurrency wallets and well-known NFT marketplaces. Learn about cold storage for larger holdings.

- Security Tip: Be wary of suspicious links or unsolicited offers.

4. Understand the Tech (Blockchain Basics)

- Action: Familiarize yourself with how blockchain transactions work and gas fees.

Conclusion: Non-Fungible Tokens (NFTs) are more than just a fleeting trend; they represent a fundamental shift in how we perceive and own digital assets. As we move through 2025, their applications will continue to expand across art, gaming, and various other sectors in the USA, UK, and Canada. While the NFT market offers exciting opportunities, it’s crucial to approach it with a clear understanding of the technology, inherent risks, and a commitment to responsible investment. Arm yourself with knowledge, proceed with caution, and explore the captivating world of NFTs.