Future-Proof Your Finances: Building Multiple Streams of Income in 2025 (USA, UK, Canada)

Introduction: In 2025, relying on a single income source is becoming increasingly risky. Economic shifts, technological advancements, and the evolving job market across the USA, UK, and Canada are highlighting the urgent need for financial resilience. Building multiple streams of income is no longer just for the super-wealthy; it’s a smart strategy for anyone looking to future-proof their finances, accelerate wealth creation, and achieve true financial freedom. This guide will explore diverse income streams and provide actionable strategies to diversify your earnings.

Why Multiple Income Streams Matter More Than Ever in 2025

This section will explain the benefits and growing importance of diversified income.

Beyond the Single Paycheck: A New Financial Reality

- Definition: Multiple income streams mean earning money from more than one source.

- Reasons for Growth in 2025: Increased economic uncertainty, desire for financial freedom, technological advancements making side hustles easier.

Key Benefits of Diversifying Your Income

- Enhanced Financial Security: A buffer against job loss or income reduction.

- Accelerated Wealth Building: More income means faster savings and investment growth.

- Greater Flexibility & Freedom: Allows for more choices in career and lifestyle.

- Skill Diversification: Opportunity to explore new talents and passions.

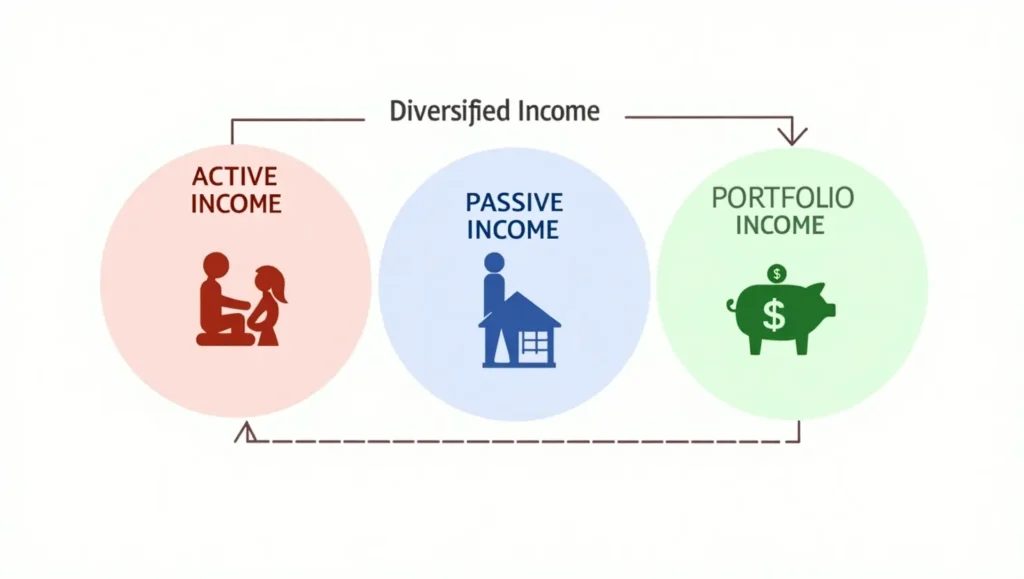

Types of Income Streams: Active, Passive, and Portfolio

Understanding the different categories helps you choose the right fit.

1. Active Income Streams

- Definition: Money earned from direct effort or time exchange.

- Examples: Primary job/salary, freelancing, consulting, side hustles (e.g., delivery, tutoring, graphic design, writing).

- Pros: Direct correlation between effort and income, often quicker to start.

- Cons: Requires active involvement, limited by time.

2. Passive Income Streams

- Definition: Money earned with minimal ongoing effort after the initial setup.

- Examples: Rental property income, royalties from books/music, ad revenue from a blog/YouTube, affiliate marketing, selling digital products (eBooks, online courses).

- Pros: Can generate income while you sleep, scales well.

- Cons: Requires significant upfront effort or investment, no immediate guarantee of return.

3. Portfolio Income Streams

- Definition: Money earned from investments.

- Examples: Dividends from stocks, interest from bonds or high-yield savings accounts, capital gains from selling appreciated assets.

- Pros: Can be truly passive, grows wealth over time.

- Cons: Requires initial capital, subject to market fluctuations.

Actionable Steps to Build Your Income Streams in 2025

Ready to start diversifying your earnings? Here’s a simplified roadmap.

1. Assess Your Skills & Resources

- Action: Identify your existing talents, hobbies, time availability, and any capital you can invest.

- Tip: This helps determine which income streams are feasible for you.

2. Start Small and Grow

- Action: Begin with one or two new income streams. Don’t try to do everything at once.

- Benefit: Allows you to learn and refine your approach without getting overwhelmed.

3. Create a Dedicated “Income Stream” Budget

- Action: Allocate specific time, effort, or money to developing each new stream.

- Goal: Track the profitability of each new venture.

4. Prioritize Automation & Scalability

- Action: Look for ways to automate tasks for passive income (e.g., auto-investing, using platforms for digital product sales).

- Benefit: Frees up your time for other streams or leisure.

5. Continuously Learn and Adapt

- Action: Stay updated on new market trends, technologies, and opportunities in 2025 (e.g., AI tools for content, new gig platforms).

- Benefit: Helps you pivot and optimize your income streams.

Challenges & Considerations When Diversifying Income

Building multiple income streams isn’t without its hurdles, especially in 2025.

- Time Commitment: Initial setup for passive income can be demanding.

- Tax Complexity: Managing taxes from various sources can be complicated (e.g., self-employment taxes, foreign income).

- Consistency: Some income streams are less predictable than a regular salary.

- Burnout Risk: Taking on too much can lead to exhaustion.

- Initial Investment: Some streams require upfront capital (e.g., real estate, advanced online courses).

Conclusion: In 2025, building multiple streams of income is a powerful strategy for individuals in the USA, UK, and Canada to enhance financial security, accelerate wealth accumulation, and gain unparalleled freedom. By understanding the different types of income, carefully assessing your skills, and embracing disciplined execution, you can navigate the modern financial landscape with confidence. Start exploring and nurturing your additional income streams today to future-proof your finances and achieve your ultimate financial goals.