Real Estate Investing in 2025: Your Guide to Smart Property Investments (USA, UK, Canada)

Introduction: Real estate has long been a cornerstone of wealth creation, offering tangible assets and potential for both income and appreciation. As we step into 2025, the property markets in the USA, UK, and Canada continue to evolve, presenting new challenges and exciting opportunities for savvy investors. Whether you’re a first-time investor or looking to expand your portfolio, understanding the current landscape and mastering smart investment strategies is key. This guide will help you navigate the world of real estate investing for profitable returns in the coming year.

Why Invest in Real Estate in 2025?

This section will highlight the enduring appeal and specific benefits of property investment.

Beyond Volatility: Stability and Tangible Assets

- Inflation Hedge: Real estate often performs well during inflationary periods as property values and rents tend to rise with general prices.

- Tangible Asset: Unlike stocks, property is a physical asset you can see and manage.

Multiple Avenues for Returns

- Rental Income: Generating consistent cash flow from tenants.

- Capital Appreciation: The value of the property increasing over time.

- Tax Benefits: Potential deductions and depreciation allowances (mention generally, as these vary by region).

- Leverage: Using borrowed money (mortgages) to control a larger asset with a smaller upfront investment.

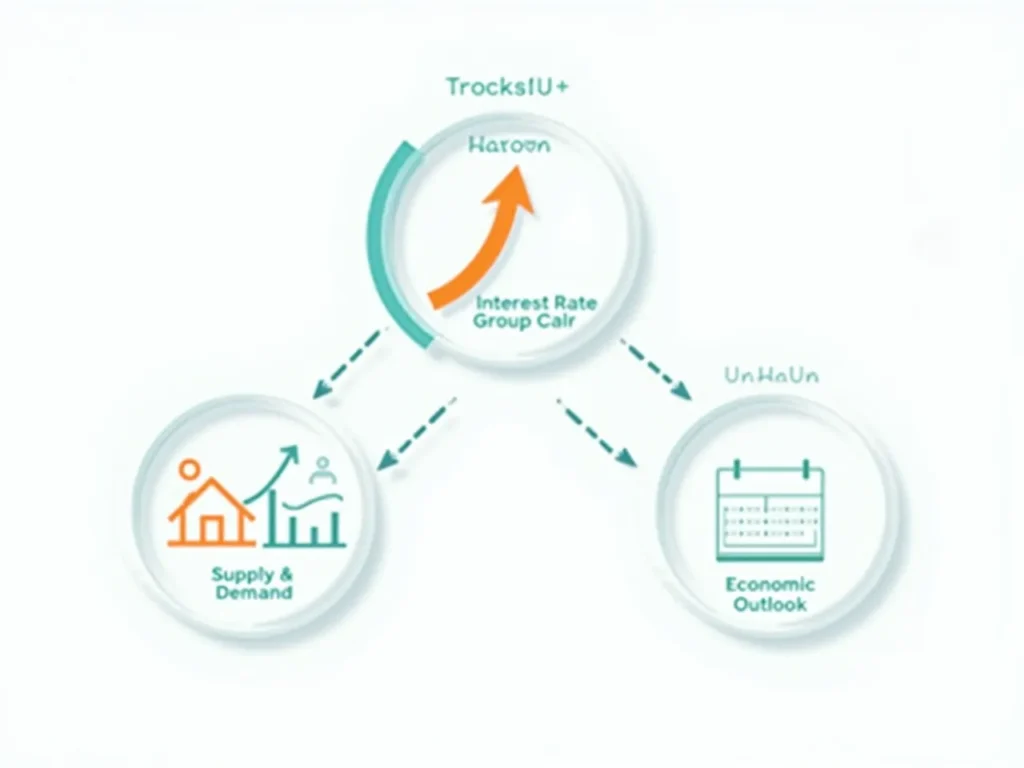

Understanding the Property Market: Key Factors for 2025

Successful real estate investing requires a keen understanding of market dynamics.

Interest Rates and Mortgages

- Impact on Affordability: How current interest rates affect borrowing costs for mortgages, influencing buyer demand and property prices.

- Strategies: Discuss adjusting expectations or exploring different financing options.

Supply and Demand Trends

- Housing Shortages: Many regions in USA, UK, and Canada still face housing supply challenges.

- Population Growth: Continuous demand from growing populations.

- Local Market Research: Emphasize researching specific local markets, not just national trends.

Economic Forecasts and Inflation’s Role

- Future Predictions: Briefly touch upon economic outlook for 2025 and how it might influence property values and rental markets.

- Inflation’s Dual Effect: How inflation affects property value vs. purchasing power.

Smart Property Investment Strategies for 2025

Beyond just buying a home, consider these popular investment approaches.

1. Rental Properties (Buy-to-Let)

- Strategy: Purchasing residential or commercial properties to rent out for cash flow.

- Considerations: Location, tenant screening, property management (DIY vs. professional).

- Benefit: Consistent passive income and long-term appreciation.

2. Real Estate Investment Trusts (REITs)

- Strategy: Investing in companies that own, operate, or finance income-producing real estate.

- Benefit: Allows you to invest in real estate without directly owning property; publicly traded like stocks, offering liquidity.

- Accessibility: Accessible via brokerage accounts.

3. Real Estate Crowdfunding

- Strategy: Pooling money with other investors to fund larger real estate projects.

- Benefit: Lower entry barrier than direct ownership, diversified projects.

- Considerations: Platform fees, project risk.

4. House Hacking

- Strategy: Buying a multi-unit property (e.g., duplex, triplex) and living in one unit while renting out the others to cover mortgage costs.

- Benefit: Significantly reduces living expenses, often leading to free housing.

Getting Started: Steps to Your First Property Investment

Ready to dive in? Here’s a simplified roadmap.

1. Build Your Financial Foundation

- Action: Ensure you have a solid emergency fund and manage existing debts.

- Down Payment: Save diligently for a substantial down payment.

2. Research Your Local Market

- Action: Identify areas with strong rental demand, growing populations, and good amenities.

- Data Analysis: Look at average rents, property values, and vacancy rates.

3. Get Your Finances in Order

- Action: Get pre-approved for a mortgage to understand your borrowing power. Improve your credit score.

4. Start Small (Consider REITs or Crowdfunding First)

- Action: If direct ownership seems daunting, begin with REITs or crowdfunding to gain exposure and understanding.

5. Seek Professional Advice

- Action: Consult with a real estate agent, mortgage broker, or financial advisor specializing in property investments. Their local expertise is invaluable.

Conclusion: Real estate investing in 2025 offers a powerful path to building lasting wealth and generating passive income for individuals in the USA, UK, and Canada. By understanding market dynamics, choosing the right investment strategy, and taking actionable steps, you can confidently navigate the property market. Whether you opt for rental properties, REITs, or crowdfunding, remember that diligent research and a long-term perspective are your greatest assets. Begin your property investment journey today and unlock the potential for significant financial growth.